ICT in Banking – ‘The Banana Skin Report breakthrough’

| Floris van den Broek |

Security

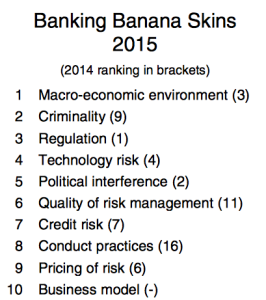

The ‘Banana Skins’ Reports are unique annual surveys about risks in the financial industry. The report is commissioned each year by PWC and carried out by the Centre for the Study of Financial Innovation. There are actual two versions: a banking banana skins report 2021 and an insurance report. both versions are very interesting reads for anyone in the financial industry and it is interesting to see how risk change year on year.

In particular this year, the world of banking seems to turn around. While last years, regulation, credit risk and liquidity topped the lists for the banker’s greatest worries, this year, starting in North America, cyber crime and the competition by non-traditional (which I’m reading as: IT savvy) companies are considered most important.

In particular this year, the world of banking seems to turn around. While last years, regulation, credit risk and liquidity topped the lists for the banker’s greatest worries, this year, starting in North America, cyber crime and the competition by non-traditional (which I’m reading as: IT savvy) companies are considered most important.

Cybercrime is nothing new for banks, but the speed of increase of sophistication of the attacks and Advanced Persisten Threats don’t go well with the fast increasing dependency on electronic banking. Of course the age of the average systems used in the financial services industry makes that there is significant legacy and that’s exactly what worries bankers most, according to the report, that mentions the ‘creaky technology systems’.

Our observation is actually that often the older systems, while they may be ‘leaky’ and easy to access, are often custom-developed in older code and therefore actually less attractive to the average hacker. The biggest risk may be in areas, where you don’t expect it and in recently developed software..In ICT Institute we work with many financial services firms and through that experience and our extensive work at the Microsoft Cybercrime center in Seattle, we have developed check-lists to evaluate and tackle the real cybercrime risks that have proven to be very helpful. Our goal is that next year Banana Skin report will report that our financial services customers feel more in control and can focus again on their real business of banking.

Dr. Floris van den Broek received his PhD in Computer Science at TU Delft and his Masters of business Administration at University of California, Berkeley. He is a a co-founder and director of ICT Institute with a focus on sales and business development. Next to his work at ICT Institute, Floris is on the board of various ICT companies and has been active in private equity. He is also a certified ISO 27001 lead auditor.